changes in estimates are accounted for using which approach?

IASB clarifies how to distinguish between a modify in bookkeeping policy and a alter in accounting estimate

It is of import to distinguish between changes in accounting policies and changes in accounting estimates because they are accounted for differently. The tabular array below shows the difference in the accounting treatment required by IAS viii Bookkeeping Policies, Changes in Accounting Estimates and Errors:

| Blazon of change | IAS 8 requirement |

| Change in accounting guess | Recognise prospectively in period of change if the change affects that flow but, or in future periods if the change affects future periods besides. |

| Alter in accounting policy | Retrospective restatement of comparatives, unless a new standard includes specific transitional requirements. |

What'southward changed?

IAS viii currently but defines 'changes in accounting estimates' and not an 'bookkeeping judge'. The recent IASB amendments innovate a definition of 'accounting estimates' as follows:

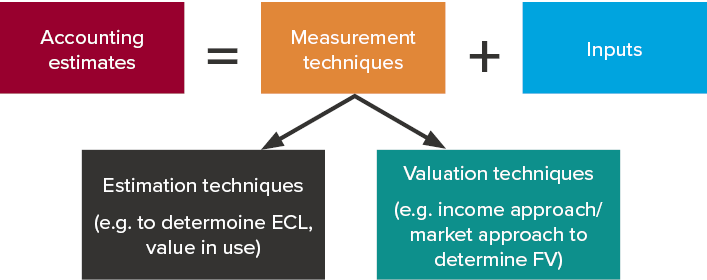

Accounting estimates are

budgetary amountsin financial statements that are subject area to

measurement dubiety.

Bookkeeping policies require transactions and balances to be measured in fiscal statements. Sometimes these values are hands observable (e.g. from a supplier invoice), but in many cases values are not directly observable and need to be measured at monetary amounts that must exist estimated. In such cases, accounting estimates are developed to achieve the objective prepare out past the accounting policy. This typically involves the employ of judgements and asusmptions.

Examples of accounting estimates

The amendments include the post-obit examples of accounting estimates:

- Expected credit loss allowances (IFRS ix Financial Instruments)

- Net realisable value of inventories (IAS two Inventories)

- Fair value of an asset or liability (IFRS thirteen Off-white Value Measurement)

- Depreciation expense (IAS 16 Holding, Plant and Equipment)

- Provision for warranty obligation (IAS 37 Provisions, Contingent Liabilities and Contingent Avails).

How does an entity develop an bookkeeping estimate?

Entities use measurement techniques and inputs to develop bookkeeping estimates. Measurement techniques include:

- Estimation techniques, typically used to guess expected credit losses and value in use of a cash-generating unit, and

- Valuation techniques used to determine fair value, east.m. an income approach or a market approach.

What is a 'change in accounting estimate'?

Post-obit on from the diagram above, the amendments clarify that at that place is a alter in an accounting estimate when in that location is a change in either of the post-obit:

- An input, or

- A measurement technique.

However, if changes in the above effect from the correction of a prior period error, then they are accounted for retrospectively, rather than prospectively.

Effective date

The amendments utilize to annual reporting periods get-go on or after ane Jan 2023, but merely to changes in accounting estimates and accounting policies that occur on or after the beginning of the first annual reporting menstruation to which these amendments first utilize.

More data

For more than information, please read our International Financial Reporting Bulletin IFRB 2022 07 IASB issues amendments to IAS 1, IAS viii and IFRS Do Statement 2 – Disclosure of Accounting Policies and Definition of Accounting Estimates.

Source: https://www.bdo.com.au/en-au/accounting-news/accounting-news-march-2021/accounting-estimates

Posted by: martinfelainum51.blogspot.com

0 Response to "changes in estimates are accounted for using which approach?"

Post a Comment